The cookie is used to store the user consent for the cookies in the category "Performance". This cookie is set by GDPR Cookie Consent plugin.

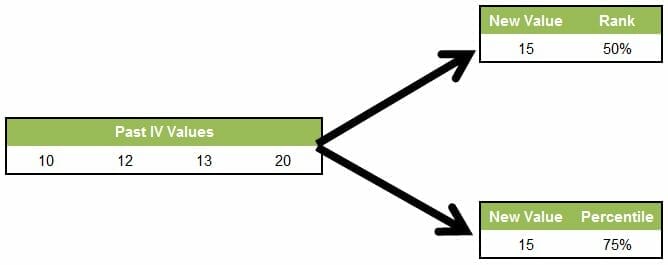

The cookie is used to store the user consent for the cookies in the category "Other. The cookies is used to store the user consent for the cookies in the category "Necessary". The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly. DABUR has an IV of 25.1, DHFL has an IV of 91.4 and INFIBEAM has an IV of 156.9! How is IV percentile useful in options trading? Let us take an example. What is a good IV for options?Ī high IVP number, typically above 80, says that IV is high, and a low IVP, typically below 20, says that IV is low. Thus the lowest IV value is 30, and the highest IV value is 60. Let’s say the IV range is 30-60 over the past year. IV Rank is a measure of current implied volatility against the historical implied volatility range (IV low – IV high) over a one-year period.

When a market’s short volatility declines below a certain percentage of its long volatility, it may be an indication that an explosive move is imminent. The Historical Volatility Ratio is the percentage of short to long average historical volatility. Using the most popular calculation method, historical volatility is the standard deviation of logarithmic returns. Standard deviation is the way (historical or realized) volatility is usually calculated in finance. Is Historical volatility the same as standard deviation? You can also do some research in the middle of the trading session to find the stocks that are moving the most that day. You can find regularly volatile stocks by using a stock screener such as StockFetcher to help you search. How do you know if a stock has high volatility? Implied volatility accounts for expectations for future volatility, which are expressed in options premiums, while historical volatility measures past trading ranges of underlying securities and indexes. What is the difference between historical and implied volatility? Many traders turn to the Today’s Options Statistics subtab on the the thinkorswim® platform from TD Ameritrade, and in particular, the Implied Volatility (IV) Percentile and Historical Volatility (HV) Percentile readings. Historical volatility is normally computed by making use of standard deviation. The historical volatility of a security or other financial instrument in a given period is estimated by finding the average deviation of the instrument from its average price. Past performance does not guarantee future results. To find implied and historical volatility in the thinkorswim® platform from TD Ameritrade, pull up a chart and select Studies > Add Study > Volatility Studies. How do I find historical volatility in thinkorswim? Is Historical volatility the same as standard deviation?.How do you know if a stock has high volatility?.What is the difference between historical and implied volatility?.Where can I find historical volatility?.How do I find historical volatility in thinkorswim?.

0 kommentar(er)

0 kommentar(er)